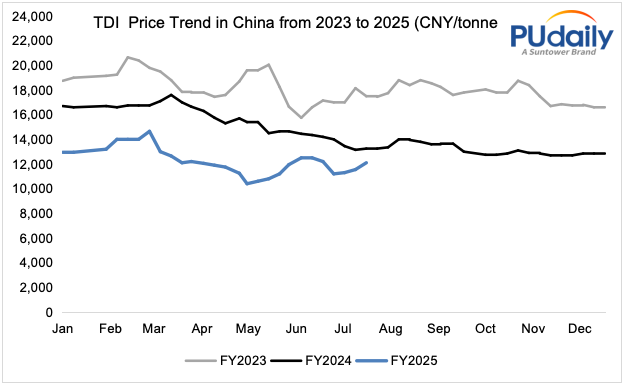

Chinese TDI market saw fluctuations after declining and then rallied in June. As the market had risen to a relatively high level and suppliers had unveiled settlement prices towards the end of May, traders’ opinions diverged in early June. Some traders began to offer small discounts and low prices were frequently heard. However, demand remained weak as many downstream sectors were in an off-season. Traders faced significant pressure to sell and further lowered prices. In mid-June, TDI prices sharply dropped to around CNY 11,000/tonne. Subsequently, the bullish news on Covestro Shanghai’s price increase and Xinjiang Heshan Juli’s maintenance plan provided a boost to the market. Traders slightly increased their prices. The market rebounded as a result. Even so, new purchase orders were limited and the trading atmosphere stayed subdued. At the end of June, Covestro Shanghai disclosed positive news of supply shortage, and Wanhua Chemical raised its early July contract price while significantly reducing supply volume, leading to a market uptick. On June 30, the reference offers of TDI in East China: Shanghai: stood around CNY 12,000-12,400/tonne in cash in drum; other Chinese products stood around CNY 11,800-12,000/tonne in cash in drum. The reference offers of TDI in South China: Shanghai: stood around CNY 12,000-12,400/tonne in cash in drum; other Chinese products stood around CNY 11,800-12,000/tonne in cash in drum.

China TDI Price Trend 2023-2025

Chinese TDI market is expected to fluctuate upwards in July. TDI prices are currently at historically low levels. Crude oil and toluene prices remain high due to frequent geopolitical conflicts, resulting in low or even negative profit margins for the TDI industry. Therefore, TDI suppliers generally intend to support higher prices. However, downstream manufacturers mostly keep just-in-time purchasing and are unlikely to significantly increase purchases due to weak demand in the off-season. Sellers fear losses if selling at low prices, while buyers resist high prices. Thus transactions remain sluggish. Amid the tug-of-war between supply and demand, TDI prices in China are projected to be range-bound and show a mild increase in the near future.