Recent China Customs’ trade data underscores a promising expansion trajectory for Chinese polyurethane (PU) manufacturers in Southeast Asia, especially within the polyols segment, a vital raw material for flexible foam production used across furniture, footwear, automotive, and insulation applications.

From January to April 2025, polyol exports from China to several Southeast Asian nations rose sharply. This trend reflects not only regional economic recovery but also efforts by Chinese manufacturers to tap into new markets and offload surplus production, amid strategic supply chain shifts and industrial investments across ASEAN economies. These moves are further reinforced by the China+1 strategy and ongoing uncertainty from global trade wars and tariff tensions, which have encouraged producers to diversify their export destinations beyond traditional markets.

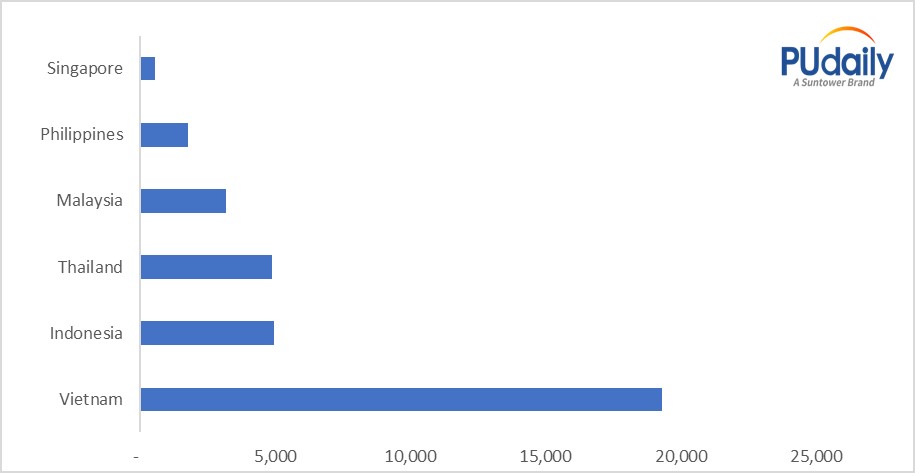

Figure 1: China's Polyether Exports Volume to ASEAN in April 2025 (Unit: Tons)

|

Jan-April 2025 |

Jan-April 2024 |

YTD % |

|

|

Vietnam |

68,708 |

48,106 |

42.8% |

|

Indonesia |

23,022 |

16,099 |

43.0% |

|

Thailand |

15,862 |

10,325 |

53.6% |

|

Malaysia |

12,654 |

9,583 |

32.1% |

|

Philippines |

7,827 |

3,952 |

98.1% |

|

Singapore |

2,424 |

2,279 |

6.4% |

Table 1: Year-to-Date Polyether Export Volumes from China to ASEAN (Unit: Tons)

Strong Growth Across Most Markets

The Philippines emerged as the most dynamic growth market in early 2025, importing 15,210 tons of Chinese polyols, a staggering +98.07% from the same period in 2024. This surge likely stems from the expansion of local flexible foam production capacity, driven by the post-COVID recovery in construction, real estate, and consumer durables, as well as potentially government-backed housing initiatives. The footwear and bedding industries also appear to be regaining momentum.

In Thailand, imports reached 17,344 tons, up by +53.63% year-on-year. This notable growth is closely tied to strategic manufacturing diversification, which encourages multinational companies to spread manufacturing beyond China.

|

April |

March |

MoM |

YoY |

|

|

Vietnam |

19,290 |

16,332 |

18.1% |

56.5% |

|

Indonesia |

4,964 |

9,316 |

-46.7% |

19.4% |

|

Thailand |

4,882 |

4,016 |

21.6% |

34.3% |

|

Malaysia |

3,185 |

3,138 |

1.5% |

11.7% |

|

Philippines |

1,773 |

3,054 |

-41.9% |

3.2% |

|

Singapore |

554 |

716 |

-22.6% |

20.7% |

Table 2: China’s Polyether Export Volume to ASEAN in April 2025 (Unit: Tons)

Thailand: A Manufacturing Hub in Transition

Thailand has become a key destination for global manufacturing diversification. The country’s Board of Investment reported a 35% increase in foreign direct investment (FDI) applications in 2024, totalling USD 33 billion. The automotive industry alone attracted USD 3 billion in investments, ranking first, while the petrochemical and chemical industry ranked fifth. This growth is driven by both geopolitical changes and proactive investment promotion policies.

This has catalyzed new investments in automotive and electronics production, which rely heavily on PU-based components, boosting demand for flexible and rigid polyols. Indonesia, which imported 15,401 tons of Chinese polyols, a +43.00% increase year-on-year, is similarly benefiting from supply chain realignment.

Indonesia: Capitalizing on Strategic Advantages

In Q1 2025, Indonesia attracted approximately US$13.67 billion in FDI, a +12.7% rise compared to the same period in 2024. The government’s “Making Indonesia 4.0” roadmap targets industrial revitalization, particularly in automotive, electronics, and chemicals.

Indonesia is the world’s third-largest footwear exporter, and its domestic car production and foam conversion capacity are both expanding. These factors are directly amplifying regional demand for Chinese polyol exports.

Vietnam remains China’s largest polyol export market in ASEAN, with 68.7 million RMB in polyol imports during Jan–Apr 2025, marking a +42.83% increase over the same period last year. In 2024, Vietnam’s full-year polyol imports had grown by +56.02%, driven by the country's role as a global contract manufacturing base, especially for furniture, footwear, and bedding destined for U.S. and European markets.

Regional Recovery & Manufacturing Expansion

The surge in Chinese polyol exports reflects ASEAN’s industrial rebound, catalyzed by export-led manufacturing growth and infrastructure investment. Key demand sectors include:

Home appliances and vehicle interiors, particularly in Thailand, where EV and electronics manufacturing are booming. In addition, trade facilitation under Regional Comprehensive Economic Partnership (RCEP) is reducing barriers. As of 2025, over 90% of trade among RCEP members benefits from zero or reduced tariffs, enhancing cost-efficiency and speed for Chinese raw materials into ASEAN.

Malaysia and Singapore: Slower but Resilient

While Malaysia’s polyol imports grew by +32.05% to 13,470 tons, the pace is more modest compared to other ASEAN countries. Still, it reflects steady growth, with 2023 and 2024 posting increases of 9.66% and 11.75%, respectively. Malaysia’s PU sector supports local construction, packaging, and bedding industries, especially in industrial clusters around Johor and Selangor.

Singapore imported 1,464 tons of polyols from China in early 2025, just a +6.35% increase.

Conclusion: Strategic Opportunities for Chinese PU Manufacturers

The double-digit export growth across nearly all ASEAN markets highlights a maturing and geographically diversifying polyurethane ecosystem. Beyond price and capacity, future competitiveness will hinge on:

As Thailand and Indonesia deepen their roles in the China+1 strategy and Vietnam continues its ascent as a PU-based contract manufacturing hub, Chinese polyol suppliers are well-positioned to solidify their regional leadership, provided they align offerings with local needs and offer technological, logistical, and collaborative value.