China’s customs data for April 2025 indicates a continued decline in polyol trade with the United States, which reflects the ongoing impact of high tariffs. However, a recent agreement between Beijing and Washington to pause any further tariff actions for 90 days may provide an opportunity for improved trade conditions in the future.

Imports: Overall Downturn

China imported 28,228 tonnes of polyols in April 2025, a 5.94% decrease from March and a 17.25% drop year-on-year. For the first four months of the year, total imports stood at 110,396 tonnes, down 15.05% compared to the same period in 2024.

Imports from the United States reached 2,014 tonnes, representing a strong 89.28% increase month-on-month, yet still down 54.16% year-on-year. From January through April, imports from the U.S. totalled 5,746 tonnes, marking a 64.69% decline year-on-year.

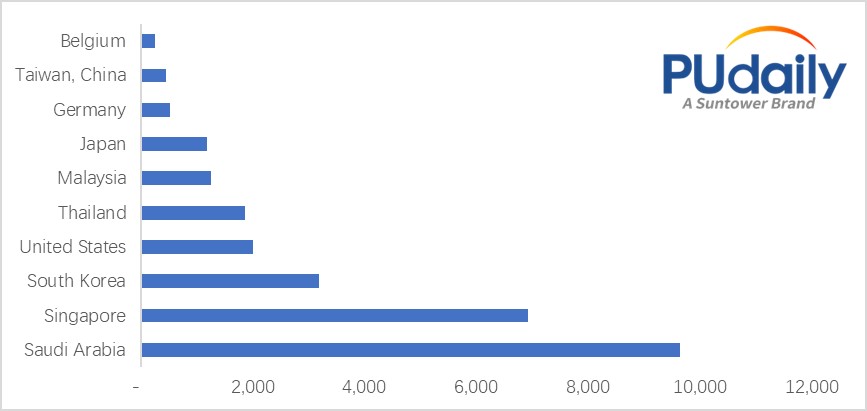

Top import origins in April included:

Figure 1: China's Polyether Imports in April 2025 (Unit: Tons)

Table 1: Polyether Import Volume, April 2025 (Unit: Tonnes, %)

|

Apr-25 |

Mar-25 |

MoM |

YoY |

|

|

Saudi Arabia |

9,657 |

5,282 |

82.8% |

34.9% |

|

Singapore |

6,927 |

11,456 |

-39.5% |

-96.5% |

|

South Korea |

3,184 |

3,009 |

5.8% |

4.6% |

|

United States |

2,014 |

1,064 |

89.3% |

21.6% |

|

Thailand |

1,859 |

4,709 |

-60.5% |

-109.4% |

|

Malaysia |

1,252 |

1,087 |

15.2% |

8.9% |

|

Japan |

1,193 |

1,193 |

0.0% |

0.0% |

|

Germany |

525 |

329 |

59.6% |

21.9% |

|

Taiwan, China |

448 |

432 |

3.7% |

2.4% |

|

Belgium |

265 |

209 |

26.9% |

32.4% |

Exports to the U.S.: Continued Weakness

Polyol exports from China to the U.S. totalled 3,020 tonnes in April, down 12.05% month-on-month and 47.92% compared to April 2024. For the January–April period, exports reached 13,099 tonnes, a 31.57% decline from the same period last year.

This follows a broader multi-year downward trend:

Table 2: U.S. Export Volume and Growth Rate, Jan-Apr 2023-2025 (Unit: Tonnes, %)

|

2025 |

2024 |

2023 |

|

|

Export Amount |

13099.40 |

19143.16 |

17952.75 |

|

YoY Change |

-31.57% |

6.63% |

-24.33% |

What Lies Ahead?

Despite the recent 90-day pause on new tariffs, the polyol trade landscape between China and the U.S. remains fundamentally altered. Market participants on both sides are continuing to reassess supply strategies amid elevated baseline tariffs and lingering uncertainty:

Unless meaningful progress is made during the current negotiation window, the existing tariff structure, 30% on Chinese exports to the US and 10% on US exports to China, could be the new normal, limiting the prospects of a full recovery in bilateral polyol trade in 2025 and beyond.

Conclusion

China’s polyol trade performance in April underscores the tangible effects of tariff-driven friction with the United States. While short-term volumes show variability, the longer-term trend has been one of contraction in bilateral flows.

The recently announced tariff moratorium provides a window of opportunity for both governments to reassess trade terms. Industry participants will be closely watching for signs of lasting resolution that could stabilize supply chains and reduce trade costs.