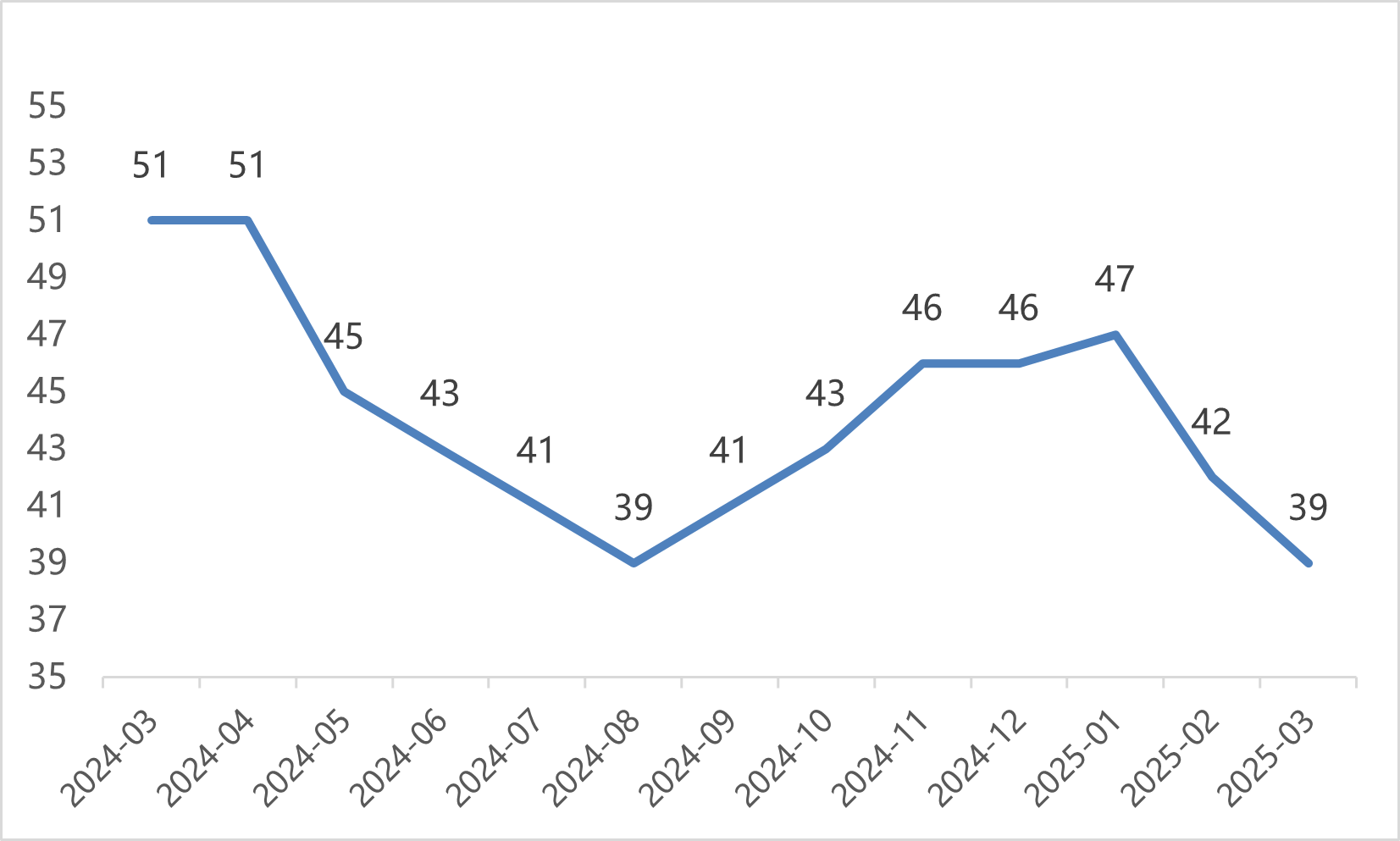

U.S. builder confidence in the single-family home sector dropped to 39 in March 2025, down three points from February and the lowest level in seven months, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The drop is attributed to multiple factors, including elevated building material costs, softening demand from potential buyers, and regional divergences. The HMI measures builder confidence through three core dimensions: current sales conditions, sales expectations in the next six months, and traffic of prospective buyers. The HMI index gauging current sales conditions fell to 43 in March, its lowest point since December 2023, and the gauge charting traffic of prospective buyers plummeted to 24. The HMI survey also revealed that 29% of builders cut home prices in March and the average price reduction was 5%; and 59% offered sales incentives. The market sentiment was weakest in the West while relatively stable in the Northeast. It means that buyers in regions with higher home prices were more sensitive to rate changes.

Figure: U.S. Home Builder Confidence Index 2024-2025

One of the main reasons for the decline in builder confidence is the elevated construction costs. An NAHB survey showed that the recent tariff policies have resulted in an average cost increase of USD 9,200 per home. Significant price fluctuations in essential materials such as wood and steel, coupled with shortages in labor and land supplies, further weighed on builders. Despite a slight decrease at the beginning of 2025, mortgage rates remained higher than pre-pandemic levels, thereby dampening housing demand. High rates not only burdened buyers but also raised financing costs and squeezed profit margins for builders. Moreover, supply chain disruptions and inflationary pressure exacerbated volatility in material prices, making it challenging for builders to predict and control costs, further weakening market sentiment.

Despite the challenges, the U.S. housing market still holds potential in the long run. Firstly, there is an estimated shortage of about 1.5 million housing units in the U.S., as population growth and changes in family structures have boosted rigid demand. Secondly, a possible rate cut by Federal Reserve might unleash pent-up housing demand. Thirdly, builders are adapting to market changes through technological innovation and cost control measures. For instance, they are adopting prefabricated components and green building materials to reduce long-term costs, and some are shifting towards suburban and small-town developments to cater to the remote working trends. On a policy level, builders are calling for eased land approvals, increased infrastructure investments, and seeking partnerships with financial institutions to broaden financing channels.

In conclusion, the U.S. housing market currently faces a trade-off between high costs and low demand. Fluctuations in the HMI reflect the impacts of macroeconomic conditions and policies. Despite significant short-term challenges, long-term structural changes and technological advancements offer hope for market recovery.