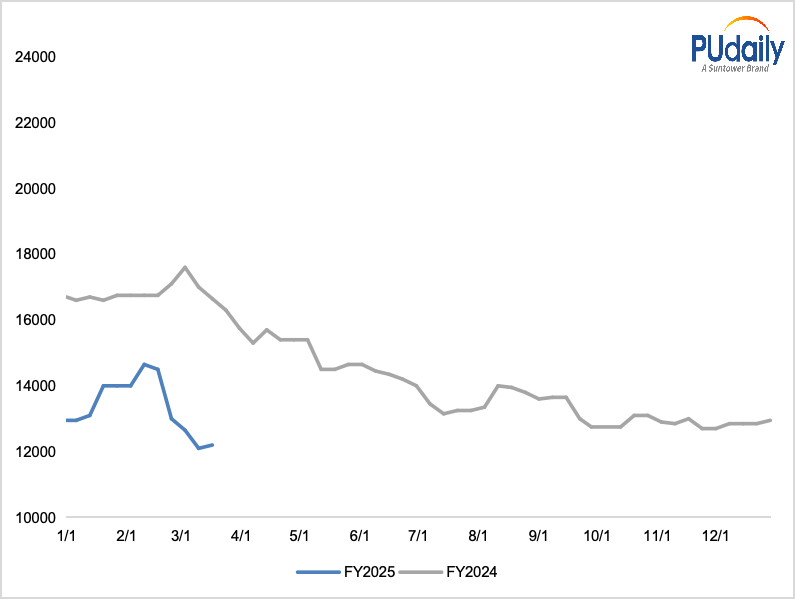

In February, China’s TDI market experienced an initial rise followed by a decline. As the retracement far exceeded the initial increase, TDI prices fell towards the low levels of the previous year. After Chinese New Year holidays, delays in the resumption of production by downstream manufacturers until after the Lantern Festival caused a sluggish recovery in demand in the early to mid-February. Despite this, positive factors such as suppliers’ collective price increases, overseas facilities maintenance, coupled with a clear intention from suppliers to support the market, resulted in a bullish sentiment among traders. TDI prices saw continuous hikes as a result. Yet, as demand recovery lagged this year, elevated pressure led buyers to resist higher-priced raw materials.

High-priced transactions were challenging after mid-February. Traders felt higher inventory pressures. Some lowered prices to promote sales, causing a market downtrend. Subsequently, consistently weak demand made traders show stronger intentions to sell. Meanwhile, an influx of low-priced goods impacted the market, accelerating the downward trend. Towards the end of the month, prices fell below the previous year’s lows, prompting some downstream manufacturers to restock, resulting in increased trading volume of low-priced goods. However, traders showed reluctance to offer more discounts due to cost constraints. The market entered a consolidation phase, with a subsequent decrease in transactions. On March 11, the reference offers of TDI in East China: Shanghai: stood around CNY 12,200-12,400/tonne in cash in drum; Other Chinese products stood around CNY 11,800-12,000/tonne in cash in drum.

China TDI Price Trend 2023-2025(CNY/tonne)

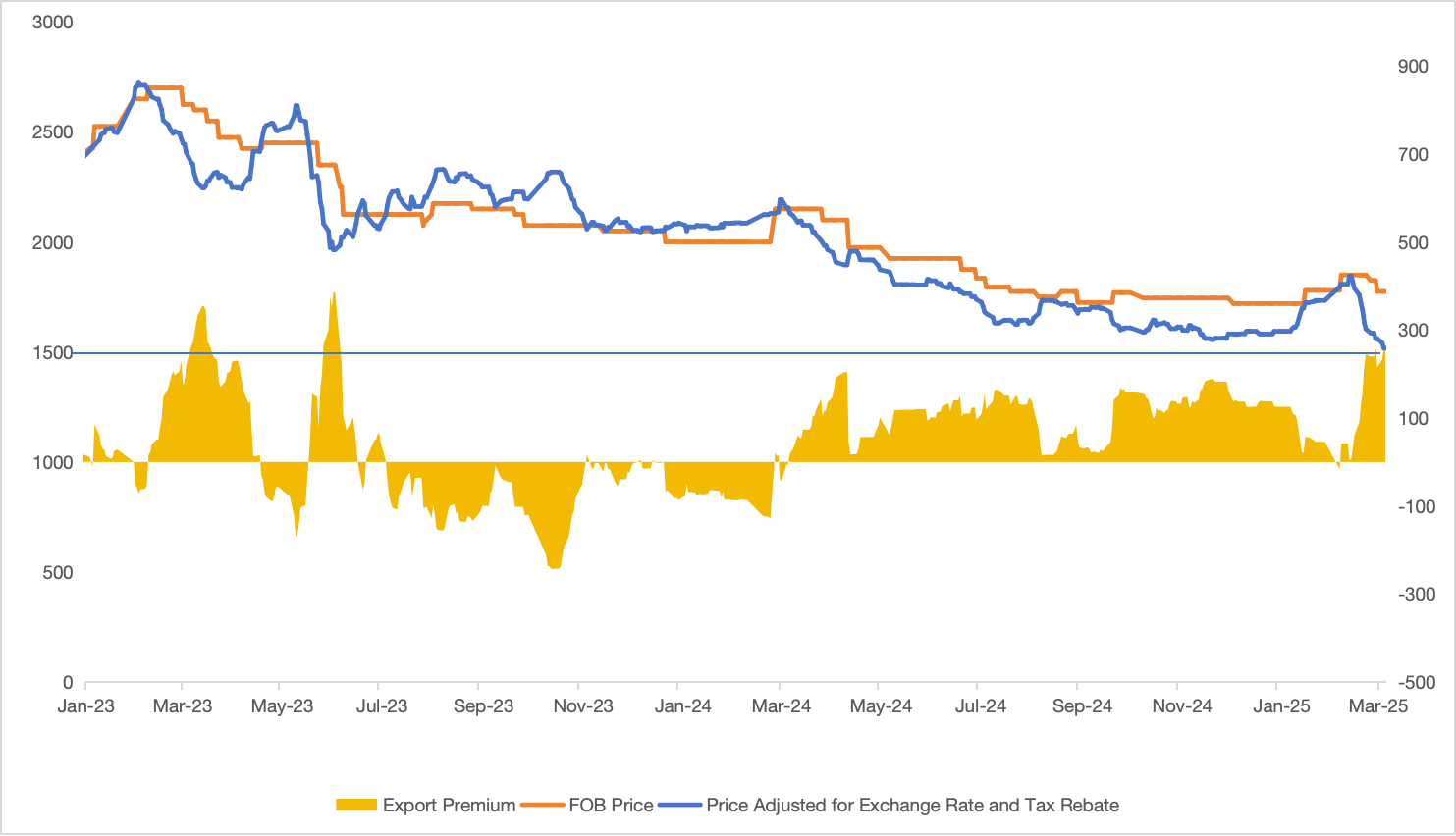

Thanks to robust demand resilience in overseas markets and some other factors, the decline in FOB prices of TDI was relatively small. On March 11, the mainstream FOB prices of TDI from China remained around USD 1,700/tonne, down by USD 80/tonne from early February and down by USD 150/tonne from the peak of USD 1,850/tonne in February.

Changes in China's TDI Export Premium (2023-2025) (Unit: USD/tonne)

By using Chinese TDI price / exchange rate / export tax rebate, we derived the converted US dollar price of TDI shown by the blue line in the figure above. This price is essentially used to measure the difference between Chinese TDI suppliers’ export and domestic prices, or the export premium. It typically fluctuates within a certain range around the Chinese FOB prices shown by the orange line. A larger deviation often indicates a significant gap between domestic and export prices, suggesting an expectation of mean reversion in the future, where the Chinese price is likely to rebound from the lows, or the export price will follow the decline.