Chinese PMDI market has stabilized since late March after a pullback in the first half of March. As of April 9, mainstream offers for PMDI originating from Shanghai suppliers stood around CNY 15,700-15,800/tonne, and those from Wanhua (PM200) stood at CNY 17,000/tonne. Although the current market tends to be in a stalemate, the relatively stable performance kept from March to present is slightly stronger than market expectations, compared to the downward trends during the same period in previous years. We believe this is mainly attributed to the rise in main raw materials prices and the concurrent improvement in demand from major downstream industries.

Raw Material Cost Side:

As geopolitical tensions flare up, global oil prices have been fluctuating and rising. Brent crude prices were closed at USD 90.76/barrel on the evening of April 8. The price of benzene, the main raw material for MDI production, has been fluctuating upwards due to the rise in oil prices. After Chinese Qingming Festival, traders and downstream manufacturers have made purchases at higher prices, providing further support to the benzene market from the demand side. As of April 8, spot offers of benzene in China stood at CNY 8,800/tonne, an increase of CNY 285/tonne from March 8. With the maintenance season for benzene facilities approaching, benzene supply in China is expected to shrink in April.

Demand Side:

Home Appliances

In China, the refrigeration industry contributes more than half of the country’s total PMDI consumption. In the January-February period, China’s refrigerator output totaled 13.74 million units, a year-on-year increase of 12.8%, according to Chinese National Bureau of Statistics. In the same period, China’s freezer output reached 5.9 million units, a year-on-year increase of 17.1%, according to ChinaIOL.com. In March, refrigerator and freezer production significantly resumed after Chinese New Year holiday. Given production schedules from April to June, China’s total output of refrigerators from January to June this year is estimated to increase by 10.5% year-on-year.

Construction

With changes in weather and other seasonal factors, Chinese construction and manufacturing industries began to pick up in March. As building material manufacturers accelerated production recovery, the prosperity index of building materials industry returned to a prosperous interval. Both building materials investment demand and industrial consumption indices surpassed critical points, rising to the prosperous interval. The index of building materials investment demand rose by 50.6 points to 129.7 compared to the previous month, and the building materials consumption index increased by 40.3 points to 122.8, indicating a stable recovery in the demand for building materials in manufacturing industries. OCF is widely used in industrial construction and home decoration for door and window installation and hole sealing. OCF manufacturers have seen growing orders since the latter half of March, boosting the demand for PMDI.

Container

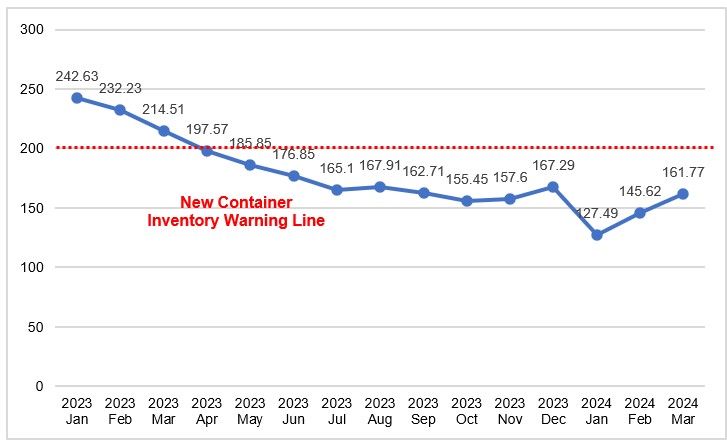

Cold chain logistics is another major downstream sector for PMDI, including reefer containers. China Container Industry Association has recently reported that Chinese new container inventory index was 161.77 in March, up 16.15 points from the previous period but still falling below the inventory alert for new containers. The index is launched by Horizon, a Chinese container data service provider. In March, Chinese exporters gradually resumed operation, with exports steadily increasing. Empty containers were rapidly consumed, and new container shipments significantly increased by 63% compared to the previous month. Although outputs of new containers remained high, the gap between production and sale was gradually narrowing, leading to a rise in the new container inventory index in March.

Horizon - New Container Inventory Index Trend (2023-2024), China Container Industry Association

China PMDI Market Outlook: a Continued Growth Trend in April

Cost: In April, uncertainties in the trend of global oil prices arising from geopolitical conflicts and other international events still exist. Oil prices are expected to remain relatively high and volatile in the near term, providing ongoing support for the main raw materials markets of MDI, namely benzene and aniline. Supply: In March, support from the supply side in Chinese PMDI market was relatively weak; however, some suppliers controlled their supply, restraining the market retreat to a certain extent. With upcoming maintenance in a Shanghai industrial park, related MDI suppliers are expected to continue controlling supply. Demand: Refrigerator production continues to show a relatively strong growth trend, and the construction industry sees a weak recovery. In a comprehensive perspective, in April, support from the supply side may slightly strengthen, and the demand side will provide a stable support. Thus there is limited potential for the market to decline. From January to March, Chinese PMDI market rose month by month. It’s predicted that the average price of PMDI in April will continue to grow both month-on-month and year-on-year.