MARKET DYNAMICS

In 2022, a series of interrelated major events, including the COVID-19 pandemic, the war in Ukraine and the resulting food and energy crisis, soaring inflation, tightening debt conditions, and climate emergencies, resulted in a severe blow to the global economy. The global economy has been seeing a slowdown in 2023 since the last year. The Asia-Pacific region is generally in a post-pandemic recovery phase, but the recovery is slow. SK Group is divesting its polyol subsidiary, SK Pucore, to reorganize its assets and accelerating the transformation of its business model towards a focus on chips and secondary battery materials. Wanhua Chemical, Changhua Chemical, and Zhejiang Petroleum & Chemical are further expanding their market positions in the polyether polyol sector and enhancing their brand image to consolidate their industry influence. However, the demand recovery in downstream industries such as upholstered furniture, automobiles, home appliances, and construction, which heavily rely on polyether polyols, is slower than expected, reflecting low market expectations, low confidence, and insufficient purchasing power. Despite the support from the cost side - propylene oxide, the mainstream prices of polyols have been constrained and fluctuated around CNY 10,000/tonne due to the imbalance between supply and demand.

Asia-Pacific Polyether Polyols Market Research Report 2023, prepared by PUdaily, focuses on the Asia-Pacific market, providing in-depth analysis of the supply-demand pattern, price trends, costs and profits, potential growth, industry opportunities and potential threats, investment environment, and more. This report will assist clients in targeting the ever-changing submarkets in the coming years, helping stakeholders make informed decisions and promote their development.

2023 vs 2022, WHAT’S NEW?

Sustainable Development: Contents related to Carbon Dioxide Polyether, Bio-based Polyether, and Recycling of Polyurethane Flexible and Rigid Foams have been added.

Derivatives: Contents relating Polyether amines with low viscosity, long application period, high toughness, anti-aging and other excellent properties are added to the market analysis. Polyether amine can be a good substitute for polyether in some materials and can improve the application performance of new materials, which has a wide range of applications in wind power, textile printing and dyeing, railway anticorrosion, waterproofing of bridges and ships, and petroleum and shale gas exploitation.

Downstream applications: New analysis of polyether consumption of main downstream (upholstered furniture, automobile, etc.), and introduction of new applications such as polyurethane composite materials are added.

Global Trade: Analysis of the import competition pattern of major polyether consuming countries such as the US, Russia, Vietnam, etc. has been added.

KEY MARKET PLAYERS

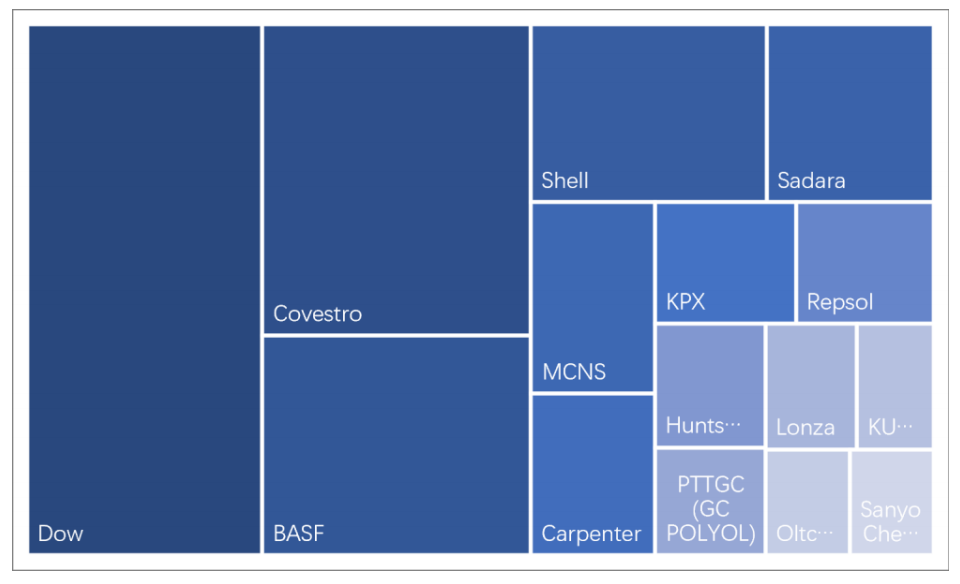

Although there are many polyether polyol production plants in the world and they are widely distributed, there are still a few manufacturers occupying most of the production capacity, and many small manufacturers coexist. In addition to China, the production capacity of large multinational companies such as Dow, Covestro, BASF, and Shell accounts for 1/3~1/2 of the global total production capacity.

GLOBAL KEY PLAYERS

We provide a holistic analysis of major competitors in the Global Polyether Polyol market, which involves delving into their capacity change and staying abreast of relevant company news.

Sample: Total production capacity of major global polyether polyol producers in 2023

CHINESE KEY PLAYERS

China's polyether polyol manufacturers are relatively scattered, and there are many types of polyether polyols. We emphasis on analyze 1) industrial chain 2) raw material procurement & product structure, and 3) advantageous products and field of the following major Chinese polyether polyol manufacturers:

DOWNSTREAM INDUSTRIES SEMENTATION

Our report provides a detailed analysis of the end-use industries of Polyether Polyol from a geographical perspective. Additionally, we delve into the development status of these industries, assess their demand for polyols, and present a comprehensive list of representative enterprises within each sector.

Sample: Proportion of downstream applications of polyurethane adhesives

Major Polyether Polyol end-use industries include:

IN-DEPTH ANALYSIS BY REGION

Our report incorporates a geographical segmentation, placing emphasis on critical factors such as supply and demand, price trend, cost and profit, market price forecast, import and export, production technology development and market forecast for Polyether Polyol in Asia-Pacific region.

* The Asia-Pacific region discussed in this report mainly includes China, Southeast Asia, Japan and South Korea, and India, excluding the countries in the Middle East and Oceania.

Sample: 2019-2023 polyether polyol production capacity in Southeast Asia (unit: in 10kT)

DISCOVER MORE

PUdaily’s collection of reports comprehensively covers the entire spectrum of the Polyurethane industry in Asia-Pacific:

CONTACT US

PUdaily’s Asia-Pacific Polyether Polyols Market Research Report 2023 is now available for purchase. For more details, place an order or to obtain free samples, please contact:

Ms. Lucy Tang

Telephone: 0086-021-61250980

Email: marketing@pudaily.com

Address: Room 607, Block B, No.1439 Wuzhong Road, Shanghai, China

Or visit our official website: https://www.pudaily.com/Home/MarketReports

ABOUT PUDAILY

PUdaily is a trustworthy market information provider of Asian, especially Chinese polyurethane intelligence for the products of TDI, MDI, Propylene Oxide, Polyether Polyols, Adipic Acid, Polyester Polyols, BDO-THF-PTMEG, Aliphatic Isocyanates, PU Systems and more. We are a brand of Suntower Consulting Limited with 17 years presence in China polyurethane market.

While real-time price tracking and vital market intelligence hook global customers into its platform, PUdaily has built up its brand, reputation and influence by offering customized solution packages and organizing industry events. Google statistics highlight our broad global reach, with a customer base extending to over 80 countries and territories. This includes discerning patrons ranging from upstream materials producers to downstream users, covering the entire spectrum of the polyurethane industry's value chain.