As technology continues to advance, polyurethane is being increasingly and widely used in daily life. Downstream applications of polyurethane cover the household, construction, daily goods, transportation, and home appliance sectors, with a particularly high proportion in the home appliance sector. With the gradual easing of the epidemic situation, overseas markets have shown an increased demand for home appliances, propelling a rapid growth in the export of home appliances. This has further boosted the production of refrigerators and freezers in China, thus benefiting the polyurethane market.

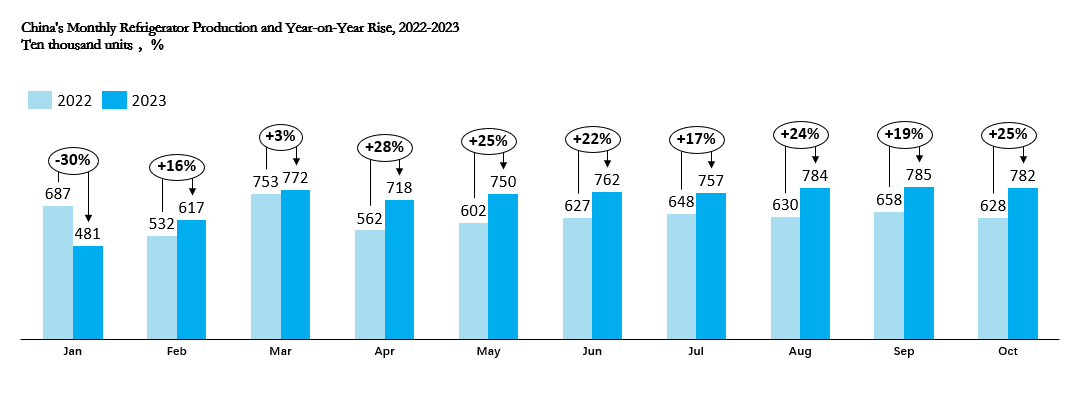

From a data perspective, China’s home appliance industry experienced a phase of rapid recovery from January to March. Although production in January declined compared to the same period in 2022, the year-on-year growth rate in February reached 16%, and March remained relatively stable with a year-on-year growth rate of 3%, showing an overall positive trend. Freezer production in China exhibited a similar trend to refrigerator production, with a year-on-year decline in January, followed by a 5% year-on-year increase in February. From April to October, the home appliance industry saw vigorous development, with particularly pleasing growth in refrigerator production, maintaining a year-on-year growth rate of around 20%, and freezer production generally maintaining a 10% year-on-year growth rate.

From the domestic market perspective, due to the high market penetration of refrigerators in China, there is limited potential for demand growth. Additionally, the home appliance industry is closely linked to the real estate industry. Real estate is basically showing no signs of recovery in China, so it cannot bring positive growth to the home appliance industry. Despite significant challenges, Chinese home appliance market is not entirely sluggish. With economic growth, increasing disposable income for residents has led to a growing demand for more intelligent and high-end refrigerators, to some extent driving the development of the refrigerator market.

Regarding the overseas market, China’s home appliance exports have witnessed a substantial increase in growth rate. In terms of refrigerator exports, starting from April 2023, the export volume showed a year-on-year growth rate; from May to October, the growth rate of refrigerator exports compared to the same period in 2022 surged by as much as 50%, showing an impressive upward trend. As for freezer exports, their performance slightly lagged behind that of refrigerators, with a positive year-on-year growth rate starting from May. From June to October, the year-on-year growth rate also significantly increased, peaking at around 50% in September. The substantial rise in export growth can be attributed to two factors: firstly, the domestic production advantages have been further emphasized after the relaxation of Covid-19 precautions, especially evident in improved port efficiency. Secondly, developed countries such as Europe, the United States, and Japan have shown a notable rebound in demand for Chinese home appliances, which being the primary driving force behind the high-speed growth in China’s home appliance production.

By export destinations, the United States has consistently held the top position in destinations of Chinese home appliance exports, with volumes surpassing those of second-place Japan by fivefold. In addition, developed countries such as Germany, France, and Australia also contributed a large share, reflecting the strong demand for Chinese home appliances overseas.