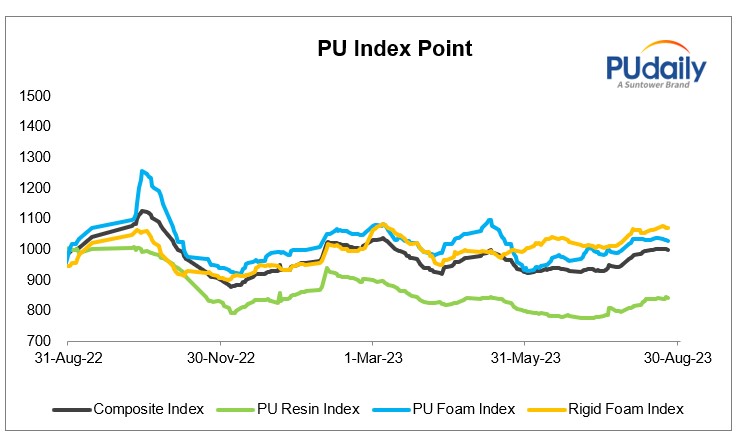

Polyurethane Price Indices 2022-2023

China composite PU index showed a slight and steady fluctuation in August. Throughout the month, policies related to stabilizing the real estate market and promoting consumption were introduced frequently, which slightly boosted the industry confidence. However, the overall market remained weak. Prices of raw materials such as isocyanates and polyols were controlled to stabilize the market, and price fluctuations within a certain range were the main trend.

China soft foam index was consolidated within a range in August. The demand recovery in the soft foam industry was not significant as expected. Downstream buyers showed weak buying interest throughout the month, with a focus on low-priced purchases for essential needs. There were no signs of increasing replenishments. Moreover, there was obvious resistance when the TDI price exceeded CNY 18,500/tonne, which limited the upward movement of the market. As a result, the soft foam market ran within a certain range in August, with limited fluctuations. Anticipated production reductions from major polyols suppliers in the northern and southern China due to maintenance work resulted in continued supply contraction. The availability of spot goods in the market remained tight, supporting the overall stability of the polyols market in August.

China rigid foam index moved downwards in August. During the month, MDI and polyols producers controlled their supply to the market, providing a relatively strong support to prices. Overall, the demand for rigid foam from downstream sectors remained stable. In the construction sector, there was a slight increase in demand from pipelines in North China, but the increase was limited. Thanks to growing exports, refrigerator and freezer manufacturers maintained stable production and sales, which led to consistent procurement of raw materials according to contract terms. The demand from insulation pipes also saw some improvement, but the increase was not significant.

China PU resin index showed an upward trend in August. In the AA market, there was a strong upward movement. In terms of raw materials, crude oil and benzene markets experienced significant increases, while AA prices rose steadily. In the middle and later stages of the month, traders had different mindsets, leading to an increase in lower-priced offers, and downstream manufacturers made purchases on demand. The BDO market also moved up this month due to steady increases in the cost side - calcium carbide and methanol. The operating rate of suppliers remained low, resulting in relatively low external supply, and online bidding prices continued to rise, supporting a bullish market sentiment from suppliers. Downstream buyers procured raw materials based on contract orders. The main downstream sector, spandex, experienced a rebound this month, which provided certain positive factors. The THF market edged up this month, supported by cost increases and increased demand from downstream PTMEG sector. The PTMEG market showed an upward trend this month, with non-spandex downstream sectors maintaining steady demand, and the spandex sector experiencing a recovery.