The automobile sector is a major pillar of a country. Being home to the modern car, Germany, the German automobile industry accounts for a large part of the country’s manufacturing production and exports. Germany is not only the largest car market in Europe, but also is known for housing some well-known car brands such as Volkswagen, Porsche, Mercedes-Benz, Audi and BMW, as well as the early leader in developing and building diesel locomotives. However, the average age of German new car buyers has climbed to 53 years old, which means that the German automobile industry is facing severe challenges. As the engine of EU economic growth, once the German economy stalls, it will affect the recovery process of the entire EU economy.

The German Federal Motor Transport Authority recently said that German automobile output and sales rebounded in 2022 after suffering two consecutive years of sharp decline due to the Covid-19 pandemic and supply chain bottlenecks.

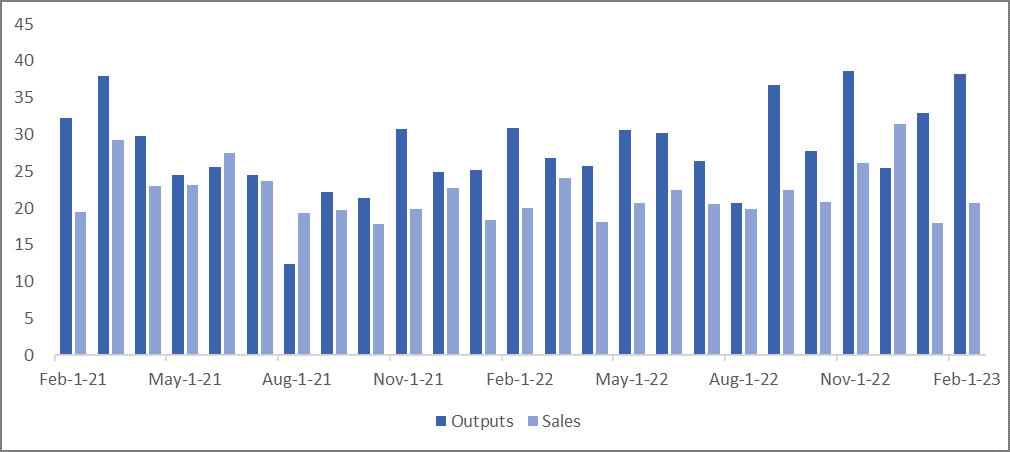

Figure 1 German Automobile Outputs & Sales, February 2022 - February 2023 (10,000 units)

Data Source: VDA

German auto output kept increasing in January and February 2023 thanks to improved supplies of raw materials and intermediate products, but the cumulative output in the period fell by 13% compared to the same period in 2019 before the pandemic, and remained at a low level. In 2022, the number of passenger cars produced in Germany totaled 3.45 million, up 11.4% year-on-year. As the only country among Europe’s major auto markets with positive growth, Germany sold a total of 2.65 million cars in 2022, a slight increase of 1.1% year-on-year, but a decrease of approximately 1 million units from 2019. In 2020 and 2021, auto sales in Germany fell 19% and 10.1% month-on-month, respectively. It is reported that the German auto market has gradually revived since the second half of 2022, with sales in December increasing by 38.1% year-on-year.

In 2022, among the new cars sold in Germany, the sales of petrol and diesel-engined cars decreased 11.2% and 9.9% respectively. But Germany saw electric vehicle sales increase 28.7% year-on-year to more than 470,000 units, taking a 17.7% share. Under the strict EU Climate Law, major carmakers have accelerated their transformation and layout in the automobile industry. German new energy vehicle industry is also experiencing a rapid growth.

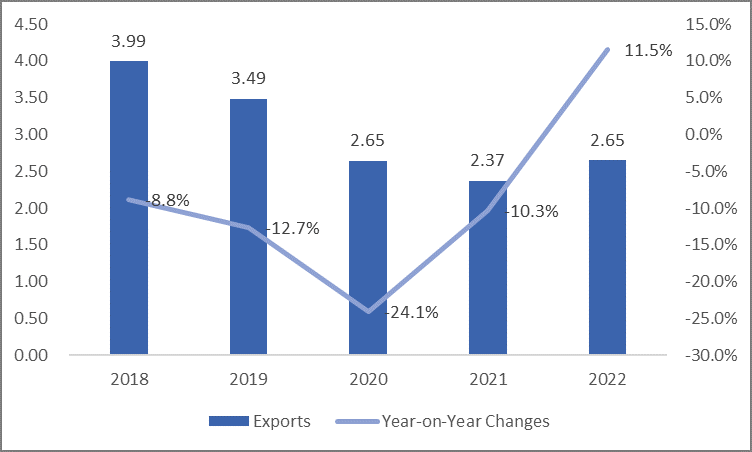

Figure 2 German Passenger Car Exports & Year-on-Year Changes, 2018-2022 (million units)

Data Source: VDA

The supply chain disruption and anti-globalization trend during the pandemic have brought great challenges to German auto exports. As the upstream and downstream sectors of the German automotive industry chain are distributed globally, Germany has faced significant headwinds amid the supply chain chaos. In 2021, German passenger car exports fell 10.3% to 2.374 million units, reaching a record low since 1996. Compared to 2017, the country’s auto exports decreased by about 2 million units. As the impact of the pandemic fades, passenger car exports in 2022 increased 11.5% year-on-year to around 2.65 million units.

As the “economic locomotive” in Europe, Germany’s economic situation is widely concerned. German car production will still be hampered by the ongoing shortage of key components such as chips in 2023 and its automobile industry will remain “worrying”. Preliminary data issued by the Federal Statistical Office of Germany (Destatis) on January 3 showed that inflation in Germany reached 7.9% in 2022, compared to only 3.1% in 2021. Bundesbank predicts that inflation in Germany will remain high above 7% in 2023. Under high inflation, the decreased purchasing power will suppress German car sales in 2023.