On April 2, 2023, the trial production of a 300 ktpa propylene oxide (PO) and supporting 900 ktpa hydrogen peroxide joint unit invested and built by Jincheng Petrochemical was successfully launched. Moreover, in 2023, four new and expanded projects totaling 1.06 mtpa PO capacity, including those by Zhejiang Petroleum & Chemical and Hongbaoli Group, are expected to start. Let me list them for you:

1. During the 2023 Spring Festival, Zhejiang Petroleum & Chemical’s Phase II 200 ktpa PO/SM compressor unit trial run was fully launched, marking the start of the “countdown” for commissioning and feedstock supply, with production expected to begin by mid-year at the earliest. On April 3, the company announced that its 60 ktpa PPG production line of a 380 ktpa polyether facility under construction had produced qualified products.

2. Currently, Hongbaoli Group’s technical renovation project (expanding the capacity of its existing 100 ktpa PO joint unit to 160 ktpa) is being accelerated. Due to energy consumption constraints in the region, some time delays have occurred, and the project is expected to be completed by the end of this year.

3. On October 28, 2022, Jiangsu Jiahong New Material’s high-performance new material Phase I project was delivered, which includes a 400 ktpa PO facility and three 450 ktpa hydrogen peroxide facilities, with the earliest possible completion date by the end of this year.

4. The Phase I project of Jiangsu Ruiheng New Materials Technology Co., Ltd., a subsidiary of ChemChina International, includes a 400 ktpa PO project, which is expected to be completed and put into operation as soon as August.

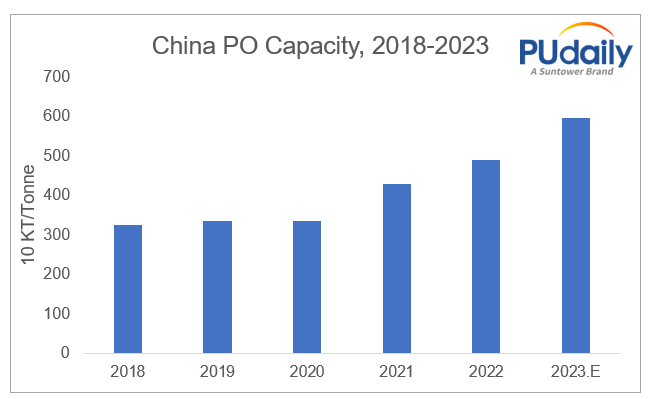

Since 2018, PO projects have sprung up everywhere of China, with a new batch of capacity additions being built and expanded.

China PO Capacity, 2018-2023

In 2021, the second phase of CNOOC Shell, Sinopec Quanzhou, and Fuqiang New Materials (the PO unit was shut down due to a fire in the hydrogen peroxide plant and has not yet been restarted) were commissioned one after another, pushing PO prices above the CNY 20,000/tonne mark. This is largely due to the sustained improvement in China’s domestic demand, combined with maintenance shutdowns at facilities in Saudi Arabia and Shell, as well as the announcement of force majeure by US polyether PO suppliers due to cold weather, leading to a continuous expansion of supply shortages and prompting China’s polyols suppliers to seize the opportunity and significantly increase their export volumes.

In 2022, new construction and expansion projects such as Sinopec Zhenhai’s Phase II, Yida Chemical, Bohai Chemical, Qixiang Tengda, etc. were started. Under a series of negative factors such as global inflation, repeated outbreaks of Covid-19 pandemic, and the Russia-Ukraine conflict, China’s domestic demand remained weak, and consumer confidence index kept declining. The continuous increase of new PO capacity exacerbated the supply-demand imbalance. PO prices fell from CNY 12,250/tonne at the beginning of the year to below CNY 8,000/tonne, a decline of 35.5%, crossing the CNY 8,000/tonne mark.

Looking back at the first quarter of 2023, China’s PO prices rose from CNY 9,000/tonne at the beginning of the year to CNY 11,300/tonne, but as of April 3, they have fallen back to CNY 9,400/tonne (Note: prices here refer to ex-factory prices in Shandong), well below the same period in 2021 and 2022.

China PO Prices, 2021-2023

As capacity continues to expand, in addition to its impact on prices, China’s dependence on PO imports is also decreasing year by year. The import volume had decreased from 474,000 tonnes in 2019 to 300,000 tonnes in 2022, and is expected to further decrease in 2023.

China PO Imports, 2018-2023

Previously, in the article “Will China April PO Market Bottom Out or Continue to Fall?”, the author analyzed that it is projected that China’s PO market will continue to fall in April, fluctuating in the range of CNY 9,000-9,500/tonne. The focus is on changes in PO facilities and demand recovery. Chinese Ministry of Commerce stated that this year, it has focused on key areas such as automobiles and home furnishings, actively promoting a series of policies and measures to promote consumption, accelerating the transformation of automobiles from purchase management to usage management, promoting new energy vehicle consumption, facilitating the circulation of used cars, developing green and smart home consumption, and further unleashing the potential for mass consumption. Whether the result of the supply-demand game for China’s PO market can hold on to the key level of CNY 9,000/tonne remains to be seen.